To effectively use an insurance documentation checklist calculator, you need to understand its core rules. These include gathering accurate, complete data, familiarizing yourself with its features, and inputting information carefully to prevent mistakes. Regularly update your data and seek expert advice when needed. Always use the tool as support, not a replacement for professional judgment, and make certain sensitive information stays secure. Keep exploring this guide to reveal the full details behind these essential rules.

Key Takeaways

- The checklist ensures accurate, complete insurance documentation, reducing errors and delays during policy management and claims.

- Familiarize yourself with the calculator’s features, interface, and security measures to efficiently navigate and protect sensitive data.

- Understand calculation methods like actuarial models and verify results to ensure consistency and accuracy in policy evaluation.

- Recognize when to consult experts for complex terms or ambiguous policy details to prevent mistakes and ensure compliance.

- Use the calculator as a decision-support tool, combining its insights with professional judgment while maintaining strict data confidentiality.

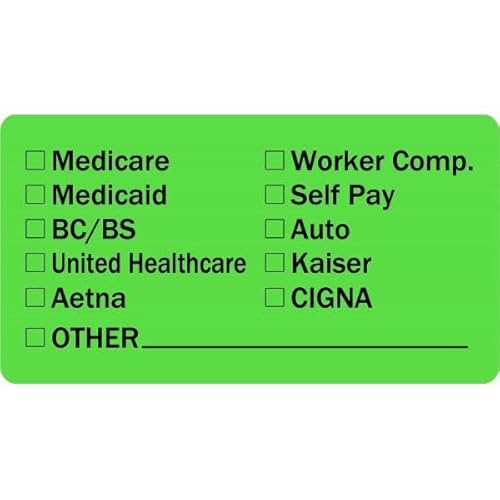

Insurance Provider Checklist Medical Labels

2" x 1" Labels

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Understanding the Purpose of an Insurance Documentation Checklist Calculator

Understanding the purpose of an insurance documentation checklist calculator helps you make certain you gather all necessary documents efficiently. This tool simplifies the process by guiding you through essential insurance terminology, ensuring you recognize key documents like policy declarations and claims forms. It also aids in policy comparison, helping you see differences between coverage options clearly. By using the calculator, you avoid missing critical paperwork that could delay claims or affect coverage. Knowing what documents are needed streamlines your preparation, making the entire insurance process less stressful. It’s an effective way to ensure you’re fully equipped before submitting claims or reviewing policies, saving you time and preventing costly mistakes. Additionally, understanding Gold IRA investment options can help diversify your financial planning strategies. Ultimately, it helps you stay organized and confident in managing your insurance needs.

Adams CMS-1500 Health Insurance Claim Forms, 2-Part, Continuous, 9.5 x 11 Inches, 100 Sets per Pack (CMS1500CV)

CMS-1500 health insurance claim form

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Gathering Accurate and Complete Data Before Using the Tool

Before using an insurance documentation checklist calculator, you need to gather all relevant and accurate information about your policies and claims. Confirm your data is complete, including policy numbers, claim details, and dates. Be mindful of data privacy; only collect information you’re authorized to access and handle sensitive data securely. Check user permissions to confirm you have the right to input and manage this information within the calculator. Avoid rushing this step—mistakes here can lead to inaccurate results or privacy breaches. Organize your documents beforehand, making sure you have everything at hand. Proper preparation guarantees a smoother process and helps maintain compliance with privacy regulations. Taking these steps minimizes errors and maximizes the tool’s effectiveness, giving you reliable insights. Additionally, understanding the types of insurance policies involved can help you provide more precise data.

The Perfect Insurance Agency: Simple Changes to Ensure Success!

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Familiarizing Yourself With the Calculator’s Features and Interface

To use the insurance documentation checklist calculator effectively, you need to familiarize yourself with its features and interface. Spend time exploring how to steer the interface smoothly; understanding where buttons and menus are will save you time. The calculator often offers feature customization, allowing you to tailor options to your specific needs. Additionally, understanding AI security measures can help you recognize how the calculator protects your sensitive information. The calculator frequently offers feature customization, allowing you to tailor options to your specific needs.

Andyer Fireproof Accordion File Organizer with Lock, Important Document Organizer Holder with Handle, 13 Pockets Expanding File Folder Binder, Portable Document Folder Storage for Business Travel

Fireproof & Waterproof & Dustproof: Fully protect your files and keep them organized with Andyer fireproof accordion file…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Correctly Inputting Information to Avoid Errors

Accurately entering information into the insurance documentation checklist calculator is essential to avoid costly mistakes. Pay close attention to the user interface, making sure you select the correct fields and double-check each entry. Use clear, consistent data to prevent confusion, especially when inputting numbers or dates. Protect data privacy by only entering sensitive information into secure fields and avoiding sharing login details. Be mindful of formatting requirements—for example, date formats or currency symbols—to reduce errors. Take your time, review entries for accuracy, and utilize any available validation prompts. Proper input minimizes mistakes, streamlines the calculation process, and ensures your results are reliable. Remember, safeguarding data privacy while carefully steering through the user interface keeps your information secure and your calculations precise. Additionally, understanding the lifestyle implications of remote work can help you create a comfortable and productive environment that enhances your overall accuracy and efficiency.

Recognizing Common Calculation Methods and Algorithms

Understanding the common calculation methods and algorithms used in insurance documentation is essential for guaranteeing accurate results. These methods form the backbone of effective risk assessment, helping you determine the appropriate premiums and coverage. Familiarity with algorithms like linear regression, decision trees, and actuarial models allows you to evaluate data efficiently and accurately. Recognizing which algorithm to deploy improves your risk assessment process and boosts algorithm efficiency. For example, simple algorithms work well for straightforward cases, while complex models are better suited for nuanced scenarios. By mastering these calculation methods, you guarantee consistency and precision in your documentation, reducing errors and streamlining decision-making. Knowing the strengths and limitations of each algorithm helps you select the best approach for every insurance calculation. Incorporating Patchology.ORG resources can further enhance your understanding of these complex methodologies.

Cross-Checking Results for Consistency and Accuracy

Cross-checking results is a crucial step in guaranteeing your insurance documentation remains reliable. By comparing policies side by side, you can identify discrepancies that might affect coverage or costs. Pay close attention to policy comparison details, especially coverage limitations, which often vary between plans. Inconsistencies in data or calculations could lead to overlooked exclusions or underestimated premiums. Use your checklist calculator to verify that figures align across different documents and that coverage limits are consistent with the policy descriptions. This process helps catch errors early, prevents costly mistakes, and guarantees your documentation reflects accurate, up-to-date information. Regular cross-checking builds confidence in your documentation process and safeguards against oversight, making your insurance management more precise and trustworthy.

Updating Data Regularly to Reflect Changes in Policy or Situation

Since your insurance policies and personal circumstances can change over time, it’s essential to update your documentation regularly. Staying current guarantees your records reflect any policy updates or claim adjustments, preventing surprises when you need them most. Regularly reviewing your info helps you spot gaps, correct errors, and adapt to life changes. Keep your documentation aligned with your current situation to avoid delays or issues during claims processing. Failing to update can weaken your coverage or cause claim denials. Additionally, understanding insurance documentation requirements ensures your records meet legal and policy standards, reducing the risk of claim disputes.

Knowing When to Seek Expert Advice or Validation

You should seek expert advice when you encounter complex situations or uncertainties that go beyond your knowledge. If you notice gaps in your understanding or need to verify policy details, it’s a clear sign to consult a professional. Doing so guarantees your documentation remains accurate and compliant with current requirements. Additionally, understanding the 1st Home Theatre Projector basics can help you make informed decisions when selecting or maintaining your equipment.

Recognizing Complex Situations

Recognizing when a situation is too complex for standard documentation is essential to guaranteeing accurate insurance coverage. If your risk assessment reveals unusual or high-stakes factors, or if comparing policies becomes overwhelming, it’s time to seek expert advice. Complex cases often involve nuanced details that can’t be captured through checklists alone. Being aware of specialized dog names and their cultural significance can also aid in understanding the full scope of your coverage needs.

Be alert to these signs:

- You’re unsure how to accurately evaluate risk levels

- Policy comparison feels confusing or incomplete

- Unique circumstances don’t fit standard templates

- Potential gaps could lead to costly mistakes

Addressing these issues early safeguards your interests and prevents overlooked details. Knowing when to bring in specialists ensures your coverage aligns with your true needs, avoiding surprises when claims arise.

Identifying Knowledge Gaps

Identifying knowledge gaps is essential to ensuring your insurance documentation is accurate and complete. When you encounter unfamiliar terms or unclear policy details, it’s a sign you need expert advice or validation. This prevents errors that could compromise data privacy or lead to compliance issues. Recognize when your understanding is limited and prioritize user education to fill those gaps. Asking professionals or consulting authoritative sources helps clarify complex concepts and ensures you’re interpreting policies correctly. Staying aware of your knowledge limits also safeguards sensitive information, reducing risks related to data privacy. By actively identifying what you don’t know, you can address gaps promptly, making your documentation more reliable and aligned with industry standards. Understanding personality traits can also improve communication with clients and colleagues, enhancing overall effectiveness. This proactive approach ultimately strengthens your overall insurance management.

Verifying Policy Details

Understanding when to seek expert advice or validation is essential in verifying policy details accurately. Your insurance policy’s language can be complex, especially regarding claim procedures and coverage limits. If you encounter ambiguous wording or unusual clauses, don’t hesitate to consult an expert. Recognizing these signs ensures you don’t miss critical details that could affect your claim. Additionally, being aware of common causes of feeling depleted or fatigued can help you identify areas where your coverage might be relevant. Seeking validation helps avoid costly mistakes, ensures your coverage is accurate, and provides peace of mind in case of claims. When in doubt, expert guidance is your best tool for verifying policy details confidently.

Using the Calculator as a Supplement, Not a Substitute, for Professional Judgment

While the calculator provides valuable insights, it should never substitute your professional judgment. Use it as a tool to support your decisions, especially when considering policy customization and claim adjustments. The calculator can highlight potential gaps or inconsistencies, but it doesn’t account for nuances unique to each case. Relying solely on its output might lead to oversights or misinterpretations. Always evaluate the context, your experience, and the specific details of each policy or claim. Remember, the calculator is a supplement that enhances your understanding, not a replacement for your expertise. Combining its data with your professional insights ensures more accurate, fair, and compliant insurance decisions. Use it wisely to reinforce, not replace, your critical judgment.

Maintaining Confidentiality and Security of Sensitive Information

Ensuring the confidentiality and security of sensitive insurance information is essential to protect clients’ privacy and maintain trust. You must prioritize data privacy by implementing strong encryption techniques to safeguard information from breaches. Protecting client data isn’t just a requirement; it’s a commitment to ethical responsibility.

Protect client privacy by implementing strong encryption—it’s an ethical commitment that builds trust and safeguards sensitive insurance data.

- Feel the weight of trust lost if sensitive data gets compromised.

- Recognize the emotional impact on clients when their privacy is violated.

- Experience peace of mind knowing encryption techniques shield crucial information.

- Understand that maintaining security fosters loyalty and confidence.

Frequently Asked Questions

Can the Calculator Predict Future Insurance Costs Accurately?

The calculator can give you a good estimate, but it can’t predict future insurance costs with perfect accuracy. Insurance accuracy depends on many factors, including changing market trends and personal circumstances. While it helps with cost prediction, you should still consider other variables and consult with an agent for a detailed view. Relying solely on the calculator might lead to unexpected surprises, so use it as a helpful guide rather than a crystal ball.

Is There a Mobile Version of the Insurance Documentation Checklist Calculator?

Yes, there’s a mobile version of the insurance documentation checklist calculator. You can access it through the insurance app, which offers seamless mobile compatibility. This means you can easily use the calculator on your smartphone or tablet, making it more convenient to manage your insurance documentation on the go. Just download the app, and you’ll have all the tools you need right at your fingertips, anytime and anywhere.

How Do I Troubleshoot Errors During Data Entry?

Remember, a stitch in time saves nine. When troubleshooting errors during data entry, first check the user interface for any obvious issues or glitches. Use data validation tools to make sure your entries meet required formats and limits. If errors persist, review your inputs for typos or missing information. Clearing cache or restarting the app can also fix minor bugs. Staying patient and methodical helps you resolve issues efficiently.

Are There Industry-Specific Features in the Calculator?

Yes, the calculator offers industry-specific features through customization options. You can tailor the tool to meet your industry’s unique requirements, ensuring more accurate results. Its feature adaptability allows you to adjust parameters and include relevant data fields, making it versatile for different sectors. This flexibility helps streamline your insurance documentation process, saving you time and reducing errors. Take advantage of these options to optimize your insurance calculations effectively.

What Are the Legal Implications of Using Inaccurate Data?

Using inaccurate data exposes you to serious legal risks, including potential lawsuits and penalties. It jeopardizes data integrity, making your insurance documentation unreliable and possibly non-compliant with regulations. You could face audits, legal actions, or damage to your reputation if errors are discovered. Always guarantee your data is accurate and verified, as maintaining data integrity protects you from legal complications and helps uphold the credibility of your insurance processes.

Conclusion

So, after all this, you’d think mastering your insurance documentation checklist calculator would be straightforward. Yet, the irony is, no matter how much you learn, it’s still only as good as the data you feed it—and mistakes can slip in just when you think you’ve got it all figured out. So, enjoy the illusion of control, but remember: even the smartest calculator can’t replace good old-fashioned professional advice!